The 45-Second Trick For Hard Money Georgia

Wiki Article

Unknown Facts About Hard Money Georgia

Table of ContentsMore About Hard Money GeorgiaThe Ultimate Guide To Hard Money GeorgiaHard Money Georgia Things To Know Before You Get ThisThe Ultimate Guide To Hard Money GeorgiaSome Of Hard Money GeorgiaHow Hard Money Georgia can Save You Time, Stress, and Money.

A hard money lending is merely a short-term funding safeguarded by realty. They are moneyed by (or a fund of investors) instead of standard lenders such as banks or credit report unions - hard money georgia. The terms are generally around 12 months, however the financing term can be encompassed longer regards to 2-5 years.The amount the hard money loan providers are able to offer to the consumer is primarily based on the worth of the subject building. The residential property might be one the borrower currently possesses as well as wants to use as collateral or it may be the building the consumer is obtaining. Hard money lenders are primarily worried about the instead than the consumer's credit rating (although credit history is still of some value to the lending institution).

When the financial institutions state "No", the hard money lending institutions can still state "Yes". A customer can get a hard cash finance on practically any kind of property consisting of single-family domestic, multi-family residential, business, land, as well as commercial. Some hard cash lending institutions might focus on one details residential property type such as residential as well as not have the ability to do land financings, simply since they have no experience in this field.

The 8-Minute Rule for Hard Money Georgia

When purchasing a main home with excellent credit, earnings history, and there are no problems such as a short sale or repossession, standard funding via a financial institution is the most effective way to go if the customer still has time to go with the prolonged approval process needed by a bank.Hard cash loans are excellent for situations such as: Land Loans Building Loans When the Customer has debt concerns. The main reason is the capacity of the difficult money lender to fund the loan promptly.

Contrast that to the 30 45 days it takes to obtain a financial institution funding funded. The application procedure for a difficult money lending generally takes a day or 2 as well as in many cases, a car loan can be approved the exact same day. Best of luck hearing back about a loan authorization from your bank within the same week! The capacity to obtain financing at a much faster rate than a financial institution loan is a substantial advantage for an investor.

Getting My Hard Money Georgia To Work

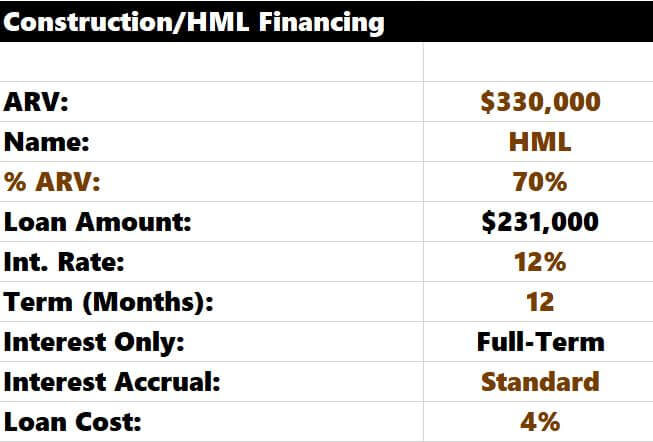

Hard cash lending institutions in California typically have lower rates than various other components of the nation because California has numerous hard cash offering firms. Increased competitors leads to a decline in costs.Due to this greater danger involved on a hard cash car loan, the rate of interest for a difficult money lending will be greater than conventional fundings. Rate of interest prices for difficult cash loans vary from 10 15% depending upon the specific loan provider and the viewed risk of the financing. Factors can range anywhere from 2 4% of the total quantity loaned.

The car loan amount the hard money lender is able to provide is established by the proportion of the car loan quantity separated by the value of a residential or commercial property. This is referred to as the financing to worth (LTV). Many dig this tough money loan providers will offer up to 65 75% of the existing worth of the property.

The Basic Principles Of Hard Money Georgia

This produces a riskier loan from the hard money loan provider's point of view due to the fact that the amount of funding placed in by the loan provider boosts and also the quantity of resources spent by the debtor decreases. This enhanced danger will certainly create a tough money loan provider to bill a higher rate of interest rate. There are some difficult cash loan providers that will provide a high portion of the ARV as well click to read as will even finance the rehab costs.Expect 15 18% passion as well as 5 6 factors when a lender funds a funding with little to no deposit from the customer (hard money georgia). In many cases, it may be worthwhile for the consumer to pay these exorbitant prices in order to safeguard the offer if they can still produce benefit from the project.

They are less concerned with the customer's credit score score. Problems on a customer's record such as a repossession or short sale can be overlooked if the customer has the resources to pay the passion on the financing. The difficult cash lending institution need to also think about the borrower's prepare for the building.

The Only Guide to Hard Money Georgia

An additional method to discover a difficult cash lending institution is by attending your local real estate capitalist club conference. These club conferences exist in most cities and are generally well-attended by tough cash lenders wanting to network with possible consumers. If no difficult cash lending institutions exist at the conference, ask various other real estate financiers if they have a difficult money lending institution they can advise.

When you need funding quickly however don't have the very best credit report, you can still obtain the funding you need provided you get the ideal funding. When it concerns realty, typical home mortgages are not your only choice. You can also count on so-called "tough cash financings." Just how do hard cash lendings work? Is a difficult money lending ideal for your circumstance? Today, we'll answer these inquiries, giving you the malfunction of difficult money financings.

Little Known Facts About Hard Money Georgia.

With standard car loan alternatives, the loan provider, such as a bank or cooperative credit union, will certainly check out your credit history as well as validate your revenue to determine whether you can pay back the finance (hard money georgia). On the other hand, with a you could try these out hard money car loan, you obtain cash from an exclusive lender or specific, and also their choice to offer will certainly concentrate on the high quality of the possession.Report this wiki page